NFT and Real Estate Agency. Is It the Future?

NFT and Real Estate Agency. Is It the Future?

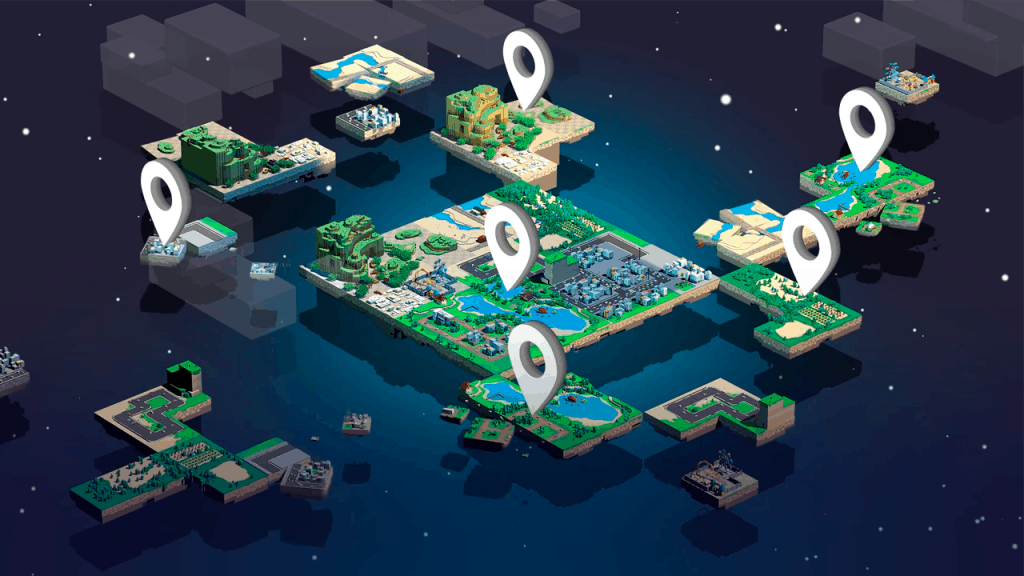

Many sectors have used cryptocurrency and blockchain technology. And, as more and more of our lives shift online, the manner in which we purchase and sell items are always evolving. With the advent of nonfungible tokens that reflect tangible assets, real estate is making its own move toward the blockchain. This technology will undoubtedly have a significant influence on commercial real estate in the future.

So, what are NFTs, exactly? They are one-of-a-kind tokens produced on the blockchain that symbolize something unique. They’re now largely used to sell digital assets like art or music, with a unique, unforgeable signature verifying ownership of the property. However, NFTs are gradually expanding to reflect ownership of tangible goods in the real world, making them a viable choice for purchasing and selling real estate.

What Are the Benefits of Using NFTs in Real Estate?

The inconvenience of transferring property ownership is one of the disadvantages of investing in real estate. Purchasing a home or obtaining an equity line of credit today necessitates a significant quantity of documentation. The transaction process is expedited using an NFT, allowing a buyer to take possession of a piece of real estate in minutes.

Cyber fraud is a common occurrence in digital transactions. You may attain greater levels of security and data integrity by combining blockchain with NFT technologies. This safeguards both buyers and sellers and makes asset transfers considerably more straightforward. Buyers can then use decentralized finance (DeFi) or traditional finance (TradFi) products on the blockchain to borrow against the NFT, bypassing the arduous due diligence required by most big banks when taking out a mortgage.

How Does It Work?

The first stage in selling real estate as an NFT is to complete the appropriate legal preparations to guarantee that it complies with legislation. This necessitates the involvement of legal counsel with blockchain experience. Maintaining compliance with the law is always a responsibility, but with the advent of new technologies, it becomes more difficult. Consider how far online banking has progressed since the internet’s inception.

You can create an NFT containing descriptive and legal data about the property if you’re ready to go forward. Minting is a procedure that anybody can conduct by uploading a JPEG and a smart contract to an NFT marketplace – a website that allows NFT makers and buyers to purchase and trade NFTs in a secure environment. This provides the NFT with all of the relevant paperwork, disclosures, and reports, allowing it to act as proof of ownership.

After you’ve finished creating the NFT, you may sell it to potential purchasers through an NFT marketplace. Buyers will place bids on the property, and the auction winner will pay in fiat money or bitcoin. The buyer will complete papers to formalize the transfer once the money have been given to you and the NFT has been transferred to the buyer’s wallet. The buyer owns the property after the NFT is purchased.

Many more NFT use cases in real estate will undoubtedly alter the sector as a whole. Overall, the process of transferring ownership should take only minutes, which is revolutionary when contrasted to the present time it takes to purchase a home. It’s just a matter of time before NFTs and real estate go hand in hand, given our demand for a “one-click” alternative for purchasing and selling.

The Problems With Using Non-Financial Transactions In Commercial Real Estate

As we’ve seen with the introduction of new technologies like telephones and the internet, there are always drawbacks, and the adoption of NFT and blockchain technology in commercial real estate is no exception. First and foremost, commercial real estate is generally held by individuals in older generations, based on what I’ve seen. In comparison to younger generations, elder generations are frequently less enthusiastic about adopting new technologies.

Second, blockchain technology is so strong that I believe it has the potential to remove many of the commercial real estate industry’s intermediaries. Title firms, for example, may face stiff competition and may follow in the footsteps of Blockbuster and payphones. Of course, this will take time.

Given how the internet has altered practically every part of our lives, I believe the NFT space will alter real estate as well, and if that is the case, there will undoubtedly be many more hurdles along the road.

Getting Ready For The Future

So, how can you get ready for the next changes in commercial real estate? First and foremost, congratulations for reading this essay. The importance of education in this area cannot be overstated. It will be impossible to comprehend all of the benefits that blockchain technology and NFTs will offer to commercial real estate without a basic grasp of the technologies.

Next? Make a purchase. When it comes to purchasing and selling NFTs, there’s a learning curve. Practicing is the only way to learn. Then sell the NFT you bought. It will pay off in the long term if you become familiar with the procedure.

Reference:

Forbes: https://www.forbes.com/sites/forbesbusinesscouncil/2022/02/16/nfts-and-the-future-of-commercial-real-estate/?sh=7e0704f69bac